Apollonian

Guest Columnist

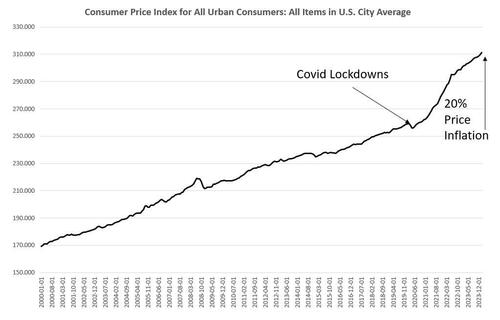

Govt Inflation # is BS -Never Mind Bogus Measures of Inflation–Purchasing Power Is What Counts, and It’s Decaying–minus 34 % since 2020

December 1, 2023 2:30 pm by CWRAuthored by Charles Hugh-Smith via oftwominds,

Link: https://citizenwatchreport.com/govt...-counts-and-its-decaying-minus-34-since-2020/

If your earnings rose by 34% from January 2020 to October 2023, congratulations, the purchasing power of your labor kept pace with higher costs.

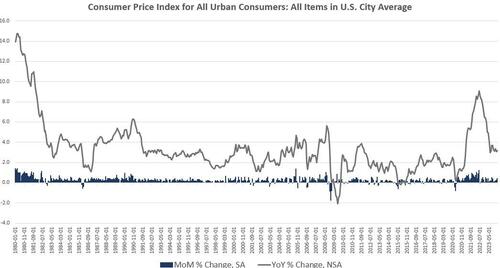

Official measures of inflation are a long-running tragi-comedy: comedic in the transparency of the distortions, and tragic in the consequences: what will you believe is true–the statistics or your lying eyes?

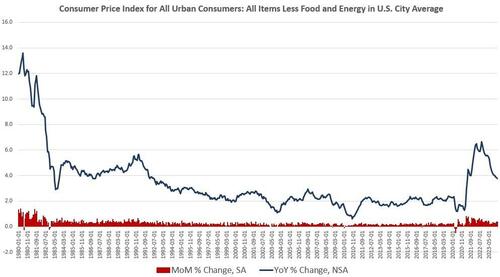

The basic gimmick of distortion is to underweight whatever is eating away at the purchasing power of earnings and highlight the trivial items that are getting cheaper due to declines in quality and globalization. So your rent went up by $200 a month, or $2,400 a year, but since TVs dropped $40 and toys dropped $20, inflation is only 3%. So stop feeling poorer, everything’s great! Inflation is dropping!

You see the problem: the scale of spending on essentials such as shelter, healthcare, childcare, etc. is far greater than the trivial “lower in price” items. If 95% of your essential spending is rising in cost, trivial declines in the 5% of discretionary spending do not offset the gargantuan declines in purchasing power.

The chart below reflects this distortion. Essential expenses that cost thousands of dollars annually consume far more of our earnings now, and these vast declines in the purchasing power of earnings are not offset by the occasional purchase of cheaper TVs.

The only accurate measure of increasing or decreasing costs is purchasing power: how many hours of work does it take to pay housing, taxes, college tuition, healthcare, childcare, etc., then and now. The official measures of inflation use gimmicks to distort the staggering drop in purchasing power by claiming the quality of stuff has increased by extraordinary leaps and bounds. So the fact that cars have rear cameras offsets the fact that it takes far more hours of labor to buy a car now than it did a few decades ago.

See also "Why is everything so expensive?"... Inflation has decreased from last year, signifying a slower rate of price increase rather than a decline in prices.

Pundits tend to overlook the fundamental sources of declining purchasing power. These include:

1. Decay of gains reaped from globalization. Stripped of corporate PR, globalization is the ruthless exploitation of as-yet unexploited pools of cheap labor and resources. This exploitation yields enormous gains at first and then these gains decay as wages rise and the easy-to-get resources are depleted.

The dependence on foreign sources for essentials has also been revealed as a national security threat, and so the catch-phrase is “de-risking,” which means developing multiple sources of essentials.

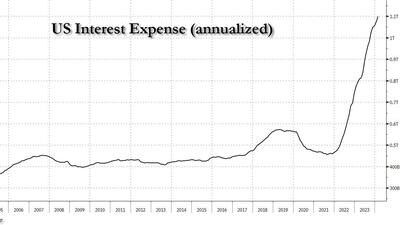

2. Capital demanding higher returns due to soaring global risks. In the conventional view, the Federal Reserve chair waves a magic wand and lowers interest rates at will. It’s not quite that simple. All new debt–for example, Treasury bonds–must be purchased by capital, and if risks are rising, capital demands a risk premium to offset the known unknowns and the unknown unknowns, both of which are proliferating rapidly.

If capital is no longer willing to accept low yields, yields have to rise regardless of central bank policy, and this drags interest rates higher. Yes, central banks can create currency out of thin air and use this free money to buy Treasury bonds, but ballooning the money supply has its own consequences:

3. Increasing the money supply to maintain a sclerotic, unproductive status quo generates a decline in the purchasing power of currency. Throwing trillions of new units of currency around doesn’t magically mean production of goods and services increase, or the quality and quantity of items increase. It just diminishes the value of existing units of currency.

See also Aussie Sen. Malcolm Roberts: ‘Klaus Schwab’s “Life by Subscription” Is Really Serfdom; It’s Slavery’ [VIDEO]

4. Global scarcities crimp supply, pushing up costs. Humans have a very high opinion of themselves, but fundamentally we’re like rabbits (or rats, if you prefer) let loose on an island without predators. Like rabbits, we proliferate and consume more per rabbit until the resources have been consumed. Then we wonder why scarcities arise. But AI, blah-blah-blah. AI can’t restore depleted soil or reverse droughts.

5. Soaring entitlements must be paid for with higher taxes. Promises made decades ago in different conditions require ever greater resources must be skimmed by governments. Creating money out of thin air isn’t a solution (see #3 above) and so the government must collect a greater share of income and wealth. The more taxes we pay, the less we have left to spend on essentials and discretionary purchases.

This is a global dynamic. Global entitlements and debt are both soaring.

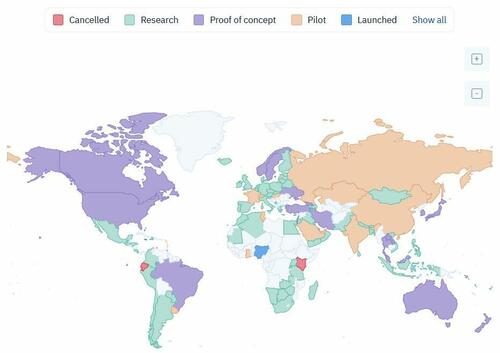

Via cbdctracker.org

Via cbdctracker.org