Apollonian

Guest Columnist

Economists look at the economy--disaster, as far as the eye can see, suckers--and creepy Joe?--hasn't got the slightest clue, nor his "advisors"

By Michael Snyder

By Michael SnyderThe numbers are in and things look surprisingly rosy for the U.S. economy:

The Federal Reserve is still cautious, but big brands – including Coca-Cola, Hilton and Visa — are singing praises to shoppers seemingly undeterred by companies’ raising prices. What’s more, Taylor Swift, Beyoncé and Barbie are enticing people to part with their money, bolstering local businesses.

Yellow, one of the country’s oldest and largest trucking businesses, is preparing to file for bankruptcy and may collapse within days, leaving some 30,000 workers without jobs.

The nearly 100-year-old company is known for its competitive pricing and has more than 12,000 trucks shipping freight across the US for brands including Walmart and Home Depot.

According to the Wall Street Journal, the company is preparing to file for bankruptcy and is in the process of selling off other parts of the business.

Anheuser-Busch, the parent company of Bud Light, announced it will lay off 350 employees, many of them in corporate positions, as it seeks to recover from the fallout over a campaign involving a trans influencer.

The total amount of corporate debt defaults in the United States this year have already exceeded the amount seen in 2022.

Experts have been warning of a wave of defaults to hit the economy for some time due to higher borrowing rates.

At least fifty-five American-based companies defaulted on their loans in the first half of 2023, according to data from Moody’s Investors Services.

That is a 53 percent increase from the total number of defaults last year, when just 36 companies said they would fail to repay their debt obligations to lenders.

#5 More than three-quarters of a million households in the state of California are behind on their rent, and now it appears that a tsunami of mass evictions is coming…Car repair costs are up almost 20% in the past year, according to the consumer price index — more than six times the national inflation rate and among the largest annual price increases of any household good or service.

So, what’s driving up prices?

It’s a combination of factors, experts said. Some emerged in the pandemic era while others are longer-term trends in the auto market, they said.

#6 Electric vehicles were supposed to be the wave of the future, but Ford is going to lose 4.5 billion dollars on electric vehicles this year alone…More than 768,000 households are behind on rent in the Golden State, with debts totaling more than $5 billion, putting approximately 721,000 children at risk of eviction, according to the National Equity Atlas—a collaborative data and analytics tool founded by Oakland-based Policy Link and the University of Southern California Equity Research Institute.

Residents in the City of Los Angeles are facing a deadline of Aug. 1 to repay all rental debt accrued between March 2020 and September 2021, with that from October 2021 to January 31, 2023, due by February 2024.

#7 A yield curve inversion normally means that a recession is coming, and right now the yield curve is the most inverted that it has been in more than 40 years…Ford Motor Company announced it is projected to lose a whopping $4.5 billion from electric vehicles (EVs) this year, up from the previous projected loss of $3 billion.

The company released its second-quarter financial results on Thursday. The U.S.-based automaker’s EV division, called “Ford Model e,” has lost $1.8 billion so far this year, according to Fortune.

#8 Just like we saw in 2008, home foreclosures are starting to surge…How big is big when it comes to the latest inversion? To measure the magnitude of the inversion, a time series of the gap between the yields on a long-term and a short-term is calculated. The most common-used measure of this is the gap between the 10-year Treasury and the 3-month Treasury. If we graph this difference between the 10-year and the 3-month, we can see that we’re now experiencing the largest inversion in more than 40 years

#9 I have repeatedly warned my readers that we are in the early stages of the worst commercial real estate crisis in U.S. history, and now one expert is comparing it to a “Category 5 hurricane”…Home foreclosures have shot up for the second year in a row – as concerns grow that owners are sitting on a ‘negative equity timebomb.’

Figures from data firm ATTOM show that around 186,000 foreclosures have been filed in the first six months of the year. The trend is being driven by an uncertain housing market and soaring mortgage rates.

#10 According to Challenger, Gray & Christmas, the number of announced job cuts in the United States during the first half of this year was 244 percent higher than the number of announced job cuts during the first half of last year…Starwood Capital Group’s Barry Sternlicht recently told Bloomberg’s David Rubenstein about the ongoing crisis in the commercial real estate sector, equating it to a severe “Category 5 hurricane”. He cautioned, “It’s sort of a blackout hovering over the entire industry until we get some relief or some understanding of what the Fed’s going to do over the longer term.”

Currently, the biggest problem in the CRE space is sliding office and retail demand in downtown areas. Couple that with high-interest rates, and there’s a disaster lurking for building owners.

Employers have announced 458,209 cuts so far this year, a 244% increase from the 133,211 cuts announced through June 2022. It is the highest first-half total since 2020, when 1,585,047 cuts were recorded. With the exception of 2020, it is the highest January to June total since 2009, when 896,675 job cuts were announced.

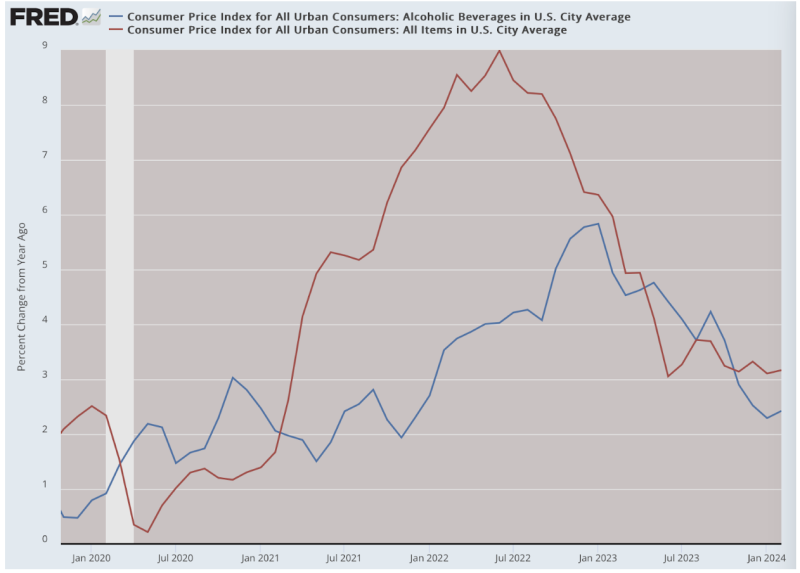

Now, on the face of it, this claim is notable because he nowhere claims that inflation does actual good, so perhaps that is a step in the right direction. If that’s true, what’s the point of printing up $5 trillion-plus in 2020 and following? No question that this is the direct cause of the loss in purchasing power of the dollar that we’ve experienced. If money is entirely neutral and inflation essentially irrelevant, the Fed should simply freeze the money stock if only to reduce anxiety.Inflation is a lot scarier when you fear that today’s price rises will permanently undermine your ability to make ends meet. Perhaps this explains why the recent moderate burst of inflation has created seemingly more anxiety than previous inflationary episodes…we’re in the midst of a macroeconomic anxiety attack.