Apollonian

Guest Columnist

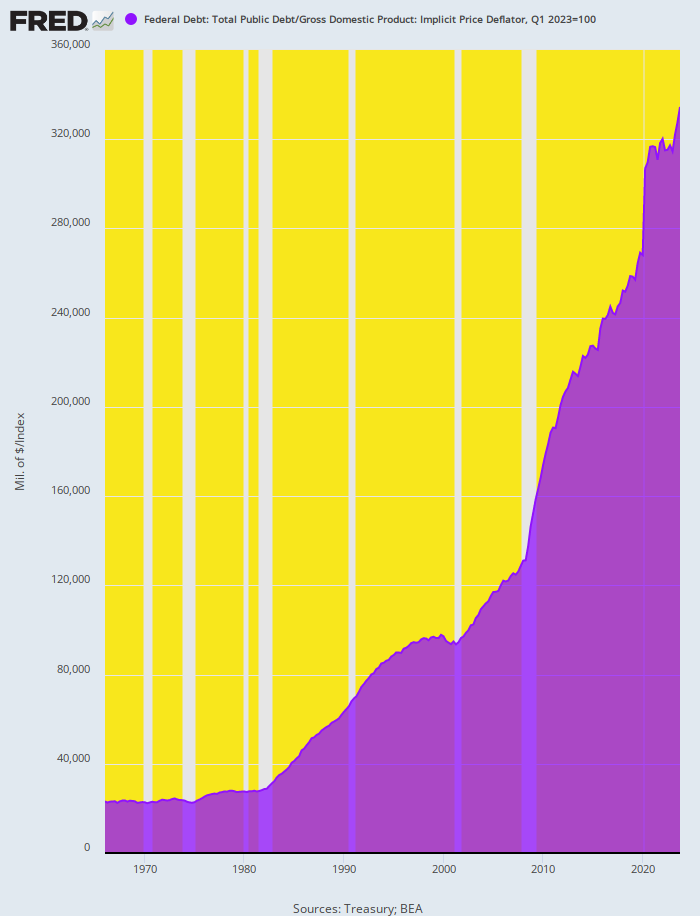

Americans Are Absolutely Drowning In Debt, And This Really Is The Worst Debt Crisis In All Of U.S. History

November 7, 2023 10:57 pm by CWRby Michael

Link: https://citizenwatchreport.com/amer...-the-worst-debt-crisis-in-all-of-u-s-history/

I truly wish that headline was an exaggeration. Unfortunately, for decades Americans have been extremely irresponsible with their finances. As a result, credit card debt is at an all-time high, auto loan debt is at an all-time high, mortgage debt is at an all-time high, corporate debt is at an all-time high, state and local governments all over the nation continue to get into absurd amounts of debt, and the federal government has piled up the single largest mountain of debt in the history of the world. Our whole society is absolutely drowning in debt at this stage, and the only way out is for the entire system to collapse.

On Tuesday, we learned that the total amount of credit card debt in the U.S. has now reached a new record high of 1.08 trillion dollars…

Credit card debt has always been one of the most insidious forms of debt, but now the banks are pushing credit card interest rates to unprecedented heights…Americans now owe $1.08 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York.

Credit card balances spiked by $154 billion year over year, notching the largest increase since 1999, the New York Fed found.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, the New York Fed’s economic research advisor.

It should be illegal to issue a credit card that has an interest rate higher than 20 percent.The rise in credit card usage and debt is particularly concerning because interest rates are astronomically high right now. The average credit card annual percentage rate, or APR, hit a new record of 20.72% last week, according to a Bankrate database that goes back to 1985. The previous record was 19% in July 1991.

If people are carrying debt to compensate for steeper prices, they could end up paying more for items in the long run. For instance, if you owe $5,000 in debt — which the average American does — current APR levels would mean it would take about 279 months and $8,124 in interest to pay off the debt making the minimum payments.

See also The largest US Banks are facing their worst Bad loan write-offs in 3 years

But banks are going to keep doing it because our politicians will not stop them.

So don’t fall into their trap.

Other forms of debt are rapidly growing as well…

Overall, U.S. households are now more than 17 trillion dollars in debt.Auto loan balances also contributed to the uptick, climbing by $13 billion over the course of the third quarter to $1.6 trillion. Student loan debt, meanwhile, increased by $30 billion while mortgage balances jumped by $126 billion to $12.14 trillion.

I can’t even begin to describe how foolish we have been.

The only way to keep the party going is to borrow even more money, but thanks to higher interest rates we are not going to be able to purchase as much.

This is something that Kevin O’Leary pointed out in a recent interview…

He is right.“We’re looking at a downsized America. I tell it like it is,” O’Leary said on “The Big Money Show.” “Three years ago, even 24 months ago, you get a mortgage at 4.5%. You’re lucky to get one at eight today. So that means the size of the house you’re going to buy is 20 to 25% smaller. That’s a downsize.”

“You want to borrow for a car? Sorry, that’s 8 to 9%. Used to be five,” the O’Leary Ventures chairman added. “So, smaller, less expensive car. That’s happening at the same time.”

But we just can’t help ourselves, and so we are going to continue to borrow more money.

The same thing is true for our corporations.

Today, corporate debt is at the highest level ever recorded.

And state and local governments continue to borrow money as if tomorrow will never come.

But the biggest offender of all is the federal government.

The national debt is currently sitting at 33.6 trillion dollars, and it is constantly going higher.

You can watch the national debt clock race upwards right here. To me, that debt clock is actually a countdown to the financial destruction of America.

Once upon a time, I warned that the U.S. would be paying a trillion dollars in interest on the national debt by the year 2030.

Well, guess what?

See also Economic Warning: Yield Curve Steepens Rapidly, Americans Spend at Fastest Rate in Two Years, Russell 2000 Hits 2020 Lows

We got there early.

According to Bloomberg, we have already crossed that ominous threshold…

Wow.Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month, Bloomberg analysis shows. That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.

The estimated interest expense is calculated using US Treasury data which state the government’s monthly outstanding debt balances and the average interest it pays.

As usual, things are even worse than many of us were originally projecting.

Before I end this article, there is one more thing that I wanted to mention.

The “glitch” that affected the direct deposit of so many paychecks all over the nation still has not been resolved five days later…

Was it really a “human error” that caused this?Federal Reserve officials are urging banks to work with customers hurt by ongoing deposit delays that have prevented some people from accessing their paychecks and other funds.

A number of customers still haven’t received their direct deposit paychecks following a “human error” that damaged the plumbing of America’s banking system. The deposit delays are linked to a problem that emerged on Friday with the Automated Clearing House (ACH) payments system, causing headaches for consumers and employers.

“The Federal Reserve encourages banks to work quickly to resolve issues for customers experiencing delays in receiving direct deposit payments as a result of operational issues at a private sector payments provider,” a Fed spokesman told CNN in a statement.

If someone just hit a wrong button, you would think that would be relatively easy to fix.

Keep a close eye on the banks. As I discuss in my new book entitled “Chaos”, the banks are the beating heart of our economy and enormous trouble is brewing.

Without healthy banks, our entire system will go haywire very rapidly.

We need to borrow money for just about every major purchase that we make, and it is the banks that make the vast majority of those loans.

If the flow of credit starts to dry up, so will our standard of living.

Unfortunately, a credit crunch has now begun, and that is going to have very serious implications for all of us.