Apollonian

Guest Columnist

According to the globalists, we are one crop failure away from ‘food system meltdown’ – new consumables added to the shortage and/or inflation list

APRIL 23, 20230 COMMENTSLink: http://www.yourdestinationnow.com/2023/04/according-to-globalists-we-are-one-crop.html

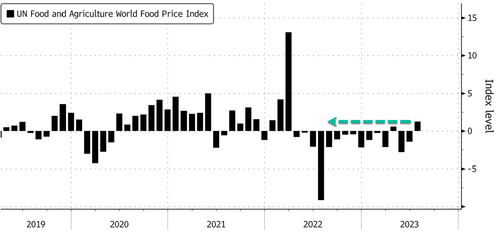

Food costs are still rising, as we see the food-at-home in February 2023 were 10.2 percent higher than in February 2022, and we feel it at the grocery store every day.

Yesterday Stefan came home from the store with four full plastic bags and a gallon of milk, and spent more than $200.

It is good thing we have emergency survival food we bought almost nine years ago, because it looks like we will be using it unless we win the lottery……..then again we don’t play the lottery, so there goes that idea.

With food inflation still topping overall inflation, and for some items, like cereals, we are talking 11%-12% increase from last year at this time.

Some key points from the USDA Economic Research Service’s March 2023 forecasts, which incorporate the February 2023 Consumer Price Index and Producer Price Index numbers.

• The food-at-home (grocery store or supermarket food purchases) CPI increased 0.3 percent from January 2023 to February 2023 and was 10.2 percent higher than February 2022

• In 2023, all food prices are predicted to increase 7.5 percent, with a prediction interval of 5.5 to 9.6 percent. Food-at-home prices are predicted to increase 7.8 percent, with a prediction interval of 5.3 to 10.5 percent. Food-away-from-home prices are predicted to increase 8.3 percent, with a prediction interval of 7.2 to 9.3 percent.

• Prices increased for 13 food-at-home categories between January 2023 and February 2023. Prices increased for all categories except fresh vegetables and eggs.

• In 2023, prices are predicted to increase for other meats (4.5 percent), poultry (3.4 percent), dairy products (6.4 percent), fats and oils (15.4 percent), processed fruits and vegetables (11.4 percent), sugar and sweets (11.1 percent), cereals and bakery products (11.7 percent), nonalcoholic beverages (10.7 percent), and other foods (8.5 percent).

• Retail egg prices decreased 6.7 percent in February 2023 but remained 55.4 percent above February 2022 prices. Egg prices are predicted to increase 29.6 percent in 2023, with a prediction interval of 13.4 to 48.9 percent. This wide prediction interval reflects the volatility in retail egg prices.

Read more here.

These are not numbers the MSM push at the people, as they prefer to focus on the lower “overall” inflation, yet food and water are the two items Americans cannot live without.

According to Foreign Policy, while we averted a “collapse of the global food system” in 2022, we are “one major crop failure or natural disaster away from a food system meltdown,” right now.

RICE WILL BE AN ISSUE……

“China is the largest rice and wheat producer in the world and is currently experiencing the highest level of drought in its rice growing regions in over two decades,” according to CNBC.

Another “major price driver” for rice is India, which has put restrictions on their rice exports

The key point in that report states “The global rice market is set to log its largest shortfall in two decades in 2023.”

While this doesn’t affect Americans as severely as those in other countries, rice is still one of the staple foods for Americans living paycheck-to-paycheck, and with the increased prices due to global shortages, buying in bulk ends up being cheaper in the long run.

Rice is not something we have focused on as much as meats and vegetables in the past, but for households that can barely make ends meet, rice is a staple used often.

Again, lucky for us, we prepared in advance, back when we actually had some money in the bank, so our buckets/pails of rice will last us a while.